One of the biggest risks to organizations nowadays is fraud. It can deplete funds, harm one’s reputation, and possibly result in legal issues. No company is safe from the dangers of financial fraud, no matter how big or little. The good news? You can identify and stop fraud before it causes irreversible damage if you have the right information and resources.

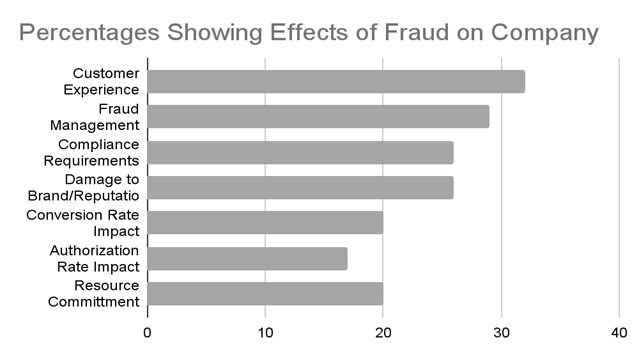

According to reports, fraud affects about 33% of organizations more frequently each year. Internal problems like embezzlement and asset theft that go unnoticed might expose your company to more false financial reporting, which could result in IRS involvement and revenue loss. The graph below shows the percentages of effect of fraud on a company:

Reducing this loss requires the use of fraud detection and prevention techniques. Since it is much easier to avoid fraud than to recoup damages after it has been committed, every company should have a plan in place. These circumstances can be avoided and financial crimes can be discovered with the help of forensic accounting services. It can assist you in determining where and how to retrieve money that has been stolen. This article explains some doable tactics to spot fraudulent activity and protect the financial stability of your company.

What is Financial Statement Fraud?

Financial statement fraud is a purposeful scheme that manipulates a company’s financial documents to purposefully create an improved perception of their performance and profitability. This type of fraud can be carried out by external entities (such as vendors or third parties) or internal parties (such as employees or management). Financial statement fraud can take many different forms, including: hiding liabilities, inflating the value of assets, forging expenses, and exaggerating revenue, among many other forms of misrepresentation.

Employees, management, or outside parties frequently falsify financial records within an organization for their own gain. Different forms of fraud can affect businesses, and each presents different difficulties. For instance, payroll fraud can include ghost workers, phony work hours, or duplicate payments, whereas embezzlement is employees misappropriating funds. Another prevalent kind of fraud is the creation of fictitious invoices or the inflating of numbers in order to steal money. Furthermore, if left unnoticed, financial statement manipulation, cost reimbursement fraud, and check tampering can result in large losses.

Signs That Your Company May Be in Danger

Businesses can avoid significant costs by identifying fraud early. Financial record inconsistencies are a big red flag. Foul play is frequently indicated by missing documents, differences between bank statements and records, and frequent bookkeeping errors. Furthermore, transactions that don’t make sense, including payments to unidentified suppliers or big cash withdrawals without explanation, should cause alarm right away.

Notable changes in employees’ lifestyles could be another indication of fraud. Workers who are living over their means and don’t have a reliable source of income can be engaging in fraud. In a similar vein, refusing to delegate tasks or take time off could indicate that someone is worried about their actions being caught while they are away.

Vulnerabilities might also result from having too much control over financial procedures. Companies should be cautious of circumstances in which one person has total authority over several financial duties without supervision. It is simpler for fraud to go unnoticed when there are no checks and balances in place.

How to Detect of Financial Statement Fraud?

Lenders can prevent the issues associated with making loans based on false information by identifying financial statement fraud early. The following are warning indicators to look out for that can assist lenders in identifying it sooner:

- Increasing sales without increasing cash flow: A company’s cash flow will often grow if its sales significantly increase. Financial statements may contain incorrect information if they show significant increases in revenue but cash flow that doesn’t correspond.

- Steady sales growth while competitors face difficulties: Researching a company’s industry and the advancements of other industry participants is a smart idea when lenders examine its financial statements. If competitors have struggled to reach sales goals for some time, yet the company applying for funding cites stable and long-term sales development, consider further inquiry.

- Significant jump in performance in the last quarter of the year: Consider it a warning indication if a financial statement reveals a significant increase in sales or revenue during the last reporting quarter of the fiscal year. When it became apparent that the corporation might not reach its annual targets, that could be a hint that someone in the organization falsified the records.

- Errors, discrepancies, or omissions of important details: All important information should be included in a genuine financial statement, free of errors. If a loan applicant provides financial statements that contain significant information missing or misrepresented, look into the matter further.

How to Respond to Fraud Suspicions?

To reduce losses and stop additional harm, prompt action is required if fraud is suspected. Performing a comprehensive inquiry is the first step. Collecting all pertinent financial documents and collaborating with auditors or forensic accountants can assist in tracking down questionable activity and revealing the truth. Evidence preservation is equally crucial. During the investigation, businesses should make sure that no emails, documents, receipts, or transaction histories are erased or changed.

Reporting the situation to law enforcement authorities is essential once fraud has been verified, particularly if criminal activity is involved. Depending on the type of fraud, regulatory bodies might also need to be informed. At the same time, vulnerabilities should be addressed with corrective measures. The persons responsible should face disciplinary punishment, and stricter internal procedures should be put in place.

7 Effective Ways to Prevent Fraud

Here, we’ve listed seven strategies to mitigate the effects of fraud and even prevent it before it occurs. So, continue reading if you’re searching for practical fraud prevention strategies.

- Take Every Case Seriously: Because fraud is so common, organizations must take it seriously, which means looking into every case. Even if it seems like a fraud may have gone unreported at first, further investigation may show otherwise. For this reason, you should look into any issue, no matter how minor or unimportant, because if someone knows they can get away with it, they’ll probably try it again, which could eventually become a much bigger problem. Therefore, your best bet is to stop fraud in its tracks and prevent it from spreading. Whether it involves an accusation against your worst or best employee, be fair, look into the accusation thoroughly, and make necessary system adjustments.

- Perform Continual Audits: One of the most important ways to prevent fraud is to carry out thorough and frequent internal and external audits. This deters fraudulent conduct, guarantees employee adherence to internal norms and regulations, and assists in identifying any abnormalities in financial data. The most manipulable areas, like payroll transactions, inventory records, and expense reports, should be the focus of audits.

- Exercise Due Diligence: Performing comprehensive due diligence on prospective and current workers, suppliers, and clients helps safeguard your company’s interests and reduce the chance of fraud. A comprehensive vetting procedure enables your company to confirm identities and search for suspicious employment and reputational patterns.

- Put in place policies for whistleblowers: Along with training, organizations should put in place whistleblower procedures to give staff members a private, secure way to report suspected fraud without worrying about reprisals. A designated individual, such as an internal audit team member or an HR representative, should take fraud allegations seriously and conduct a comprehensive investigation.

- Make use of accounting software that has fraud detection features: Use fraud detection features like anomaly detection in contemporary accounting software to identify odd transactions. These systems have the ability to monitor user behavior and produce reports that facilitate the identification of any anomalies.

- Regularly review and reconcile financial records: To find inconsistencies or indications of fraudulent activity, financial statements, regularly reconcile bank accounts and records. Errors or intentional manipulations can be detected by keeping an eye on transactions while comparing them to invoices or supporting documentation.

- Safeguard Financial Information and Records: Take the necessary precautions to protect both digital and physical financial records. Use restricted access and secured filing cabinets for physical documents, and make sure digital records are encrypted and safely backed up.

Clearwealth Thoughts on Fraud Detection and Prevention

Preventing fraud necessitates constant attention to detail and a robust system of checks and balances. Businesses may safeguard their reputation and financial stability by recognizing the warning signs of fraud and putting effective preventative measures in place.

Clearwealth is here to help, whether you need to conduct an internal audit, create or review written fraud policies and processes, or provide new and updated background checks on every employee. With our corporate fraud investigations and fraud prevention assessments, we can assist your organization in identifying and preventing fraud as well as mitigating any possible losses.

Our expertise at ClearWealth Accounting Advisory is assisting companies in securing their resources and putting strong internal controls in place. Take the first step toward a future free from fraud by getting in touch with us today for a consultation. Call us at (437) 290-5117 or visit our website clearwealth.tax to learn more.