What Tax-Efficient Wealth Management Really Means

Many people equate wealth planning with portfolio performance. In reality, strong wealth management in Ontario is structural.

Think of it like building a house:

- Cash flow is the foundation.

- Tax planning is the insulation (quietly saving money each year).

- Investments are the growth engine.

- Risk management protects against derailment.

- Clean records prevent compliance stress.

The goal isn’t to outsmart the system. It’s to use the rules as designed—especially registered accounts and legitimate deductions—to preserve and grow capital sustainably.

The Three Core Accounts: RRSP, TFSA, and FHSA

For many Ontario households, these accounts deliver the most consistent long-term impact.

TFSA: Tax-Free Growth and Flexibility

The TFSA allows investment growth and withdrawals to be generally tax-free. Government-published limits show the annual TFSA dollar limit has been $7,000 in recent years (subject to change by year).

Why it matters:

- Ideal for flexibility (career changes, sabbaticals, business buffers).

Often powerful for younger professionals expecting higher future tax brackets.

RRSP: Deduction Today, Tax Later

RRSP contributions reduce taxable income (subject to personal contribution room). Published limits indicate annual maximums exceeding $30,000 in recent years, though individual room depends on earned income and pension adjustments.

Why it matters:

- Particularly valuable for higher earners in strong marginal brackets.

- Works well when paired with TFSA (deduction now + flexibility later).

FHSA: Structured First-Home Strategy

The FHSA was introduced to support eligible first-time buyers. Government guidance outlines annual participation room of $8,000 (with lifetime framework up to $40,000, subject to rules).

Qualifying withdrawals require meeting specific conditions, including having a written agreement to purchase or build and intending to occupy the home as a principal residence.

Why it matters:

- Combines elements of RRSP and TFSA for first-home planning.

- Paperwork accuracy is critical.

Timing Often Beats Perfection

Tax efficiency is frequently about execution timing—not chasing ideal investments.

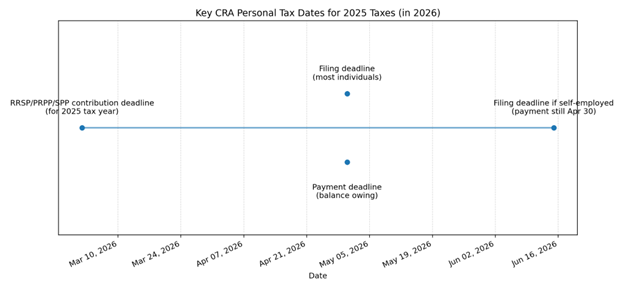

Key deadlines (as published by CRA for recent tax years):

- Early March: RRSP contribution deadline for prior tax year

- April 30: Filing and payment deadline for most individuals

- June 15: Filing deadline for self-employed individuals (payment still typically due April 30)

Missing a deadline by a week can cost more than imperfect portfolio allocation.

Wealth Management for Business Owners: Integrated Strategy

If you own a business, your wealth plan and tax plan are inseparable.

Clean Books Drive Better Outcomes

Strong bookkeeping allows you to:

- See true profitability

- Prepare for payroll and tax obligations

- Support deductions if reviewed

- Plan cash distributions confidently

Plan for HST Early (Ontario)

Ontario’s Harmonized Sales Tax is 13% (5% federal + 8% provincial). Registration requirements depend on revenue thresholds and business activity.

Practical discipline:

- Track HST separately.

- Maintain a dedicated tax reserve account.

This prevents remittance surprises that disrupt cash flow.

Capital Gains Awareness (Timing Matters)

Recent federal announcements have discussed changes to capital gains inclusion rates with deferred implementation timelines. Because legislation and thresholds can evolve, business owners and investors should review planned asset sales carefully with an accounting professional before executing major transactions.

Policy transitions create planning windows—but also complexity.

Common Wealth Management Mistakes

- Treating RRSP and TFSA as mutually exclusive.

- Missing predictable deadlines.

- Delaying bookkeeping cleanup.

- Over-prioritizing deductions while neglecting cash flow.

- Guessing on FHSA withdrawal eligibility.

Long-term wealth rarely collapses because of one bad investment. It erodes from small, repeated inefficiencies.

A Practical Roadmap for Ontario Professionals

1. Map Your Cash Flow

Identify:

- Income sources

- Fixed and variable expenses

- Monthly savings capacity

- Upcoming major goals

2. Systematize Record-Keeping

Personal:

- T-slips

- Receipts (medical, childcare, donations, tuition)

Business:

- Separate accounts

- Monthly bookkeeping cadence

- Payroll and sales tax tracking

3. Sequence Accounts Intentionally

- Flexibility priority → Often TFSA first

- High-income deduction priority → Often RRSP focus

- First-home goal → FHSA (if eligible), then coordinate

Use government-published contribution limits as guardrails each year.

4. Build a Repeatable Tax Calendar

Add:

- RRSP deadline

- Filing/payment deadlines

- Quarterly reviews for business owners

5. Review Annually (Minimum)

Trigger points:

- Notice of Assessment received

- Income changes

- Hiring or business expansion

- Major asset purchase or sale

Frequently Asked Questions

Do I need both an RRSP and a TFSA?

Often yes. RRSP may provide stronger immediate deductions; TFSA offers flexibility and tax-free withdrawals.

What are the current TFSA and RRSP limits?

Government tables publish annual TFSA limits (recently $7,000 per year) and RRSP maximums above $30,000, though personal room varies.

When is the RRSP deadline?

Typically early March for contributions applied to the prior tax year (confirm annually).

I’m self-employed—when is my return due?

Filing is typically mid-June, but balances owing are generally due April 30.

Is FHSA participation really $8,000 per year?

Government guidance outlines an annual participation room of $8,000 with lifetime limits subject to calculation rules.

How much is HST in Ontario?

Ontario’s HST is 13%.

Are capital gains rules changing?

Recent announcements referenced deferrals and potential inclusion-rate changes. Because legislation evolves, confirm current law before acting.

Final Thought: Calm Beats Complexity

Strong wealth management is rarely flashy. It’s disciplined.

- Clean records

- Intentional account use

- Awareness of deadlines

- Coordinated business and personal strategy

If you’d like help reviewing your current structure—personal tax planning, bookkeeping systems, payroll setup, or long-term strategy—we can map out a practical, tax-efficient plan tailored to your situation.