If you’re investing in Canada in 2026, you’re not just managing markets—you’re managing rule changes. And the biggest challenge usually isn’t the tax rate itself. It’s the surprise: a bigger-than-expected bill, a missed form, or a reporting rule you didn’t realize applied to you.

The theme for 2026 is Canadian Tax transparency and proactive planning. More income and asset data is being reported to the CRA through different channels (platform reporting, expanded trust reporting, proposed crypto reporting). At the same time, investors are still adjusting to changes that began in 2024—like the revamped Alternative Minimum Tax (AMT)—which can create unexpected tax payable even when your “regular” calculation looks fine.

This guide is written for Ontario investors and Ontario small-business owners who invest personally or through a corporation. It’s plain English, practical, and focused on what to do next.

Quick start: pick your path

Choose the section that matches your situation:

I invest in stocks/ETFs in a non-registered account

Focus on:

- Capital gains and losses

- Adjusted cost base (ACB) tracking

- T-slips and matching what you report to what the CRA may already have

Watch for:

- AMT if you have large gains or use certain deductions/credits

I’m a high-gain investor or I might sell a business/investment property

Pay close attention to:

- Timing and thresholds tied to the proposed capital gains inclusion rate change

- AMT exposure in the same year as a large gain

I own a rental property (or earn income through platforms)

Understand:

- Reporting rules tightening around platform reporting

- Recordkeeping for expenses, invoices/receipts, and income

I hold foreign assets (US stocks, foreign accounts, overseas property)

Review:

- Whether Form T1135 applies (threshold-based)

What’s changing heading into 2026

Several developments matter most for investors.

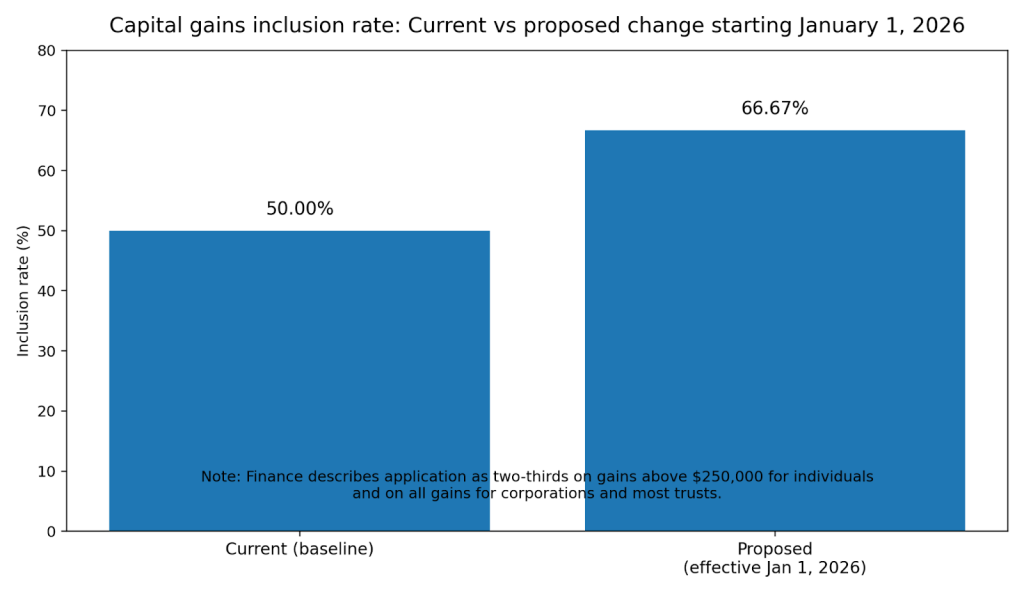

1) Capital gains inclusion rate: a new target start date

Canada’s Department of Finance announced a deferral: the proposed increase in the capital gains inclusion rate (from one-half to two-thirds) was deferred to January 1, 2026.

In plain language:

- Inclusion rate = the portion of a capital gain that is taxable.

As described by Finance, the proposal targets:

- Individuals: gains above $250,000 annually

- Corporations and most trusts: all gains

That’s why “capital gains tax planning Canada 2026” is such a hot topic: timing and structure could matter—especially if you invest through a corporation or expect a large one-time gain.

Quick view: why timing matters (conceptual)

| Scenario | Why investors care | What to document now |

| You may trigger a large gain | The year you realize gains can affect taxable inclusion | Expected sale date, estimated gain, cost base support |

| You invest through a corporation | Proposed rules may apply differently to corporations | Corporate investment schedule, shareholder plans |

| You have multiple assets (stocks, real estate, business) | Different transactions can stack in the same year | A “big year” calendar and a mid-year review |

2) AMT is already here—and investors are still getting surprised

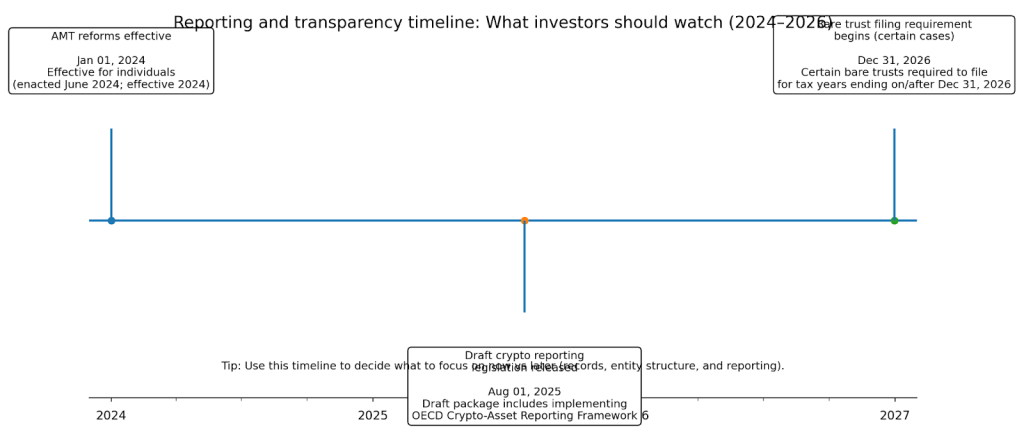

Major AMT reforms were enacted and effective starting January 1, 2024 (via legislation that received Royal Assent in June 2024).

AMT is a parallel tax calculation designed to ensure higher-income taxpayers pay at least a minimum amount when certain preferences (deductions/credits) reduce regular tax too much.

Why it matters in 2026:

- Investors are now seeing AMT issues show up on recent returns (2024/2025 filings), and that changes how 2026 planning should be approached.

- AMT can arise when you trigger large gains or use certain deductions/credits in the same year.

Decision point: If you expect a “big” transaction year (sale, large gain, options, gifting/donating securities), treat AMT as a planning item—not an afterthought.

3) Trust reporting rules are evolving (including bare trusts)

The CRA’s trust reporting update notes that certain bare trusts will be required to file for taxation years ending on or after December 31, 2026. It also outlines proposed changes affecting which trusts must file and which information schedules may be required depending on the year and conditions.

If you’ve ever had a “simple” arrangement—like holding an asset in one person’s name for another person—this is the area to watch.

4) More reporting from platforms—and proposed crypto transparency

The CRA has guidance for the Reporting Rules for Digital Platform Operators (Income Tax Act Part XX), which sets due diligence and reporting requirements for platform operators.

Separately, the Department of Finance released draft legislation (August 2025) that includes implementing the OECD Crypto-Asset Reporting Framework in Canada (draft stage).

Even if your tax rate doesn’t change, reporting rules can change the likelihood that the CRA already has relevant information—so accuracy and documentation matter more.

| Channel | What’s changing | What investors should do |

| Platforms (rentals, gig marketplaces, etc.) | Operators may have due diligence and reporting obligations | Keep monthly summaries, invoices/receipts, expense support |

| Crypto (draft direction) | Proposed framework may expand information reporting | Export transaction history, reconcile wallets/exchanges, retain cost base support |

What this means for Ontario investors

Ontario residents file a combined federal/provincial return. So when the federal tax base shifts, Ontario outcomes often shift too.

The takeaway isn’t “panic.” It’s this:

- Keep better records.

- Plan larger transactions earlier.

- Don’t treat “I didn’t get a slip” as “I don’t have to report it.”

A strong Canadian tax strategy in 2026 is less about cleverness and more about clean tracking and smart timing.

The planning moves that help most in 2026

This isn’t about loopholes. It’s about reducing avoidable surprises and staying compliant.

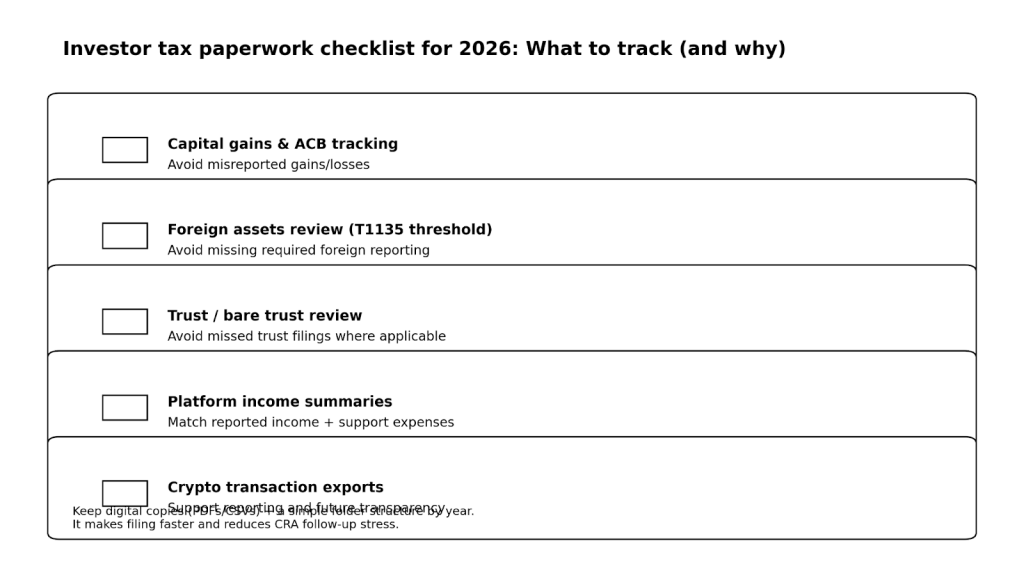

Keep capital gains and ACB clean

If you buy the same ETF multiple times, your ACB is not “the last price you paid.” In most common cases, it’s a running average.

Brokerage summaries help, but they can be wrong—especially with:

- USD trades and FX effects

- Corporate actions (splits, mergers)

- Return of capital distributions

Practical step: Maintain your own ACB tracker (or confirm your method with your advisor), especially when positions span years.

Be deliberate about selling decisions

If the inclusion rate change applies to you (especially if you’re near or above the threshold described by Finance), the year you realize gains may matter.

This is where “2026 tax planning for investors Canada” becomes personal: the same trade can have very different tax consequences depending on the rest of your year.

Don’t ignore AMT risk on “big” years

If you’re donating securities, exercising options, or realizing large gains, AMT may be part of your planning conversation—even if it never mattered before.

Check reporting obligations early—not at tax time

Use a simple early-year review:

- Foreign assets: confirm whether you need to file T1135 (threshold-based).

- Trust/bare trust scenarios: confirm whether your arrangement is likely to fall into required reporting in 2026–2027 timeframes.

Platform income: keep monthly summaries and proof of expenses.

Step-by-step roadmap for investors

1) Build your “tax dashboard”

Collect and keep these items current:

- Investment statements and realized gain/loss summaries

- Contribution receipts (RRSP) and a TFSA activity summary (for your own tracking)

- Crypto transaction exports (if applicable)

- Rental income/expense ledger (if applicable)

- Foreign asset list for a T1135 review

2) Identify your biggest tax drivers for 2026

Ask:

- Are you likely to realize a large capital gain?

- Are you investing personally, through a corporation, or via a trust?

- Do you have foreign holdings above the reporting threshold?

- Are you expecting one-time events (sale of property/business, options, large bonus)?

3) Run a mid-year check (don’t wait for March/April)

Mid-year is when you still have choices:

- Harvesting losses (where appropriate)

- Timing sales

- Cleaning up records and slips

- Confirming any new reporting exposure

4) Close the year with clean records

Investors who save the most time and stress do one thing consistently: they don’t try to rebuild the year from scratch.

Common mistakes that trip up investors

- Assuming a “proposed” change doesn’t matter until it becomes law. It may not affect a return until enacted—but it can affect planning decisions, especially around timing.

- Mixing investing and bookkeeping. Small business owners: keep investment activity separated from business bookkeeping unless it’s inside the corporation.

- Forgetting foreign reporting. T1135 is threshold-based and the definition of “specified foreign property” can surprise people.

- Missing trust/bare trust considerations. “It’s just in my name for convenience” can still be a trust-like arrangement.

- Underestimating AMT. AMT changes were effective from 2024, and they can show up in investor-heavy years.

FAQ

Is the capital gains inclusion rate changing in 2026?

Finance announced the proposed increase (from one-half to two-thirds) was deferred to January 1, 2026, with the structure described for individuals above $250,000 and for corporations/most trusts.

Does the $250,000 threshold mean my first $250,000 of gains is tax-free?

No. This is about the inclusion rate applied to gains (the taxable portion), not a “tax-free” amount. The exact application depends on final legislation and your facts.

What is AMT and why are investors talking about it now?

AMT is an alternate tax calculation. Major reforms were enacted in 2024, making AMT more relevant to higher-income and investor-heavy situations.

I live in Ontario—does federal tax change affect me?

Often, yes. Ontario taxes are integrated with federal taxable income concepts. Your actual impact depends on your situation.

Do I need to file T1135 if I own US stocks?

It depends on whether your specified foreign property exceeds the relevant threshold and how the rules apply to your situation. The CRA provides the form and instructions—review them carefully.

What’s happening with bare trust reporting?

The CRA says certain bare trusts will be required to file for taxation years ending on or after December 31, 2026, and it outlines proposed changes and exceptions for earlier years.

I earn money through a platform—does that change my taxes?

Income is generally taxable whether you receive a slip or not. The CRA has guidance on platform operator reporting rules that support broader transparency.

Is Canada bringing in crypto reporting?

The Department of Finance released draft legislation (August 2025) that includes implementing the OECD Crypto-Asset Reporting Framework in Canada (draft stage).

A quick reminder before you act

This is general information—not tax, legal, or financial advice. Investor outcomes can change based on income mix, entity structure (personal vs corporation vs trust), and timing.

If you’re planning a large sale or complex transaction in 2026, it’s worth getting personalized guidance.

Next steps: turn 2026 changes into a clear plan

If you want help translating these Canada investment tax changes into a practical plan, we can review your:

- Investment income and capital gains picture

- Reporting obligations (T-slips, T1135, platform income)

- AMT exposure in “big” years

- Year-ahead timing strategy

Book a tax planning call.