You do not want to miss refunds, benefits, or credits you are entitled to. You also do not want the sinking feeling that comes when a slip is missing, your CRA account is locked, or you filed too early and now need to correct your return.

The good news is that preparing for Canada tax season 2026 does not have to be stressful. With a simple plan, you can gather the right documents, avoid common filing mistakes, and meet important CRA deadlines without a last minute scramble.

This guide is written for Ontario residents, but most steps apply across Canada. We will cover what you need to file taxes, when filing opens on February 23, 2026, what slips arrive when, and the habits that make tax season smoother each year.

Quick Start: Pick Your Path

Choose the checklist that fits your situation.

If you are an employee with straightforward taxes

- Confirm you can sign in to your CRA account

- Wait for key slips such as T4 and T5

- Gather donation and medical receipts

- File once you have most slips, usually by the end of February

If you are self employed or a small business owner

- Reconcile bookkeeping and bank accounts

- Collect business income and expense summaries

- Confirm GST or HST and payroll records are up to date

- Plan for instalments or a balance owing

If your life changed in 2025

- Moved, married, separated, had a child, started school, bought or sold investments

- Gather supporting documents early to avoid missing credits

If you want the fastest refund

- Use NETFILE once it opens February 23, 2026

- Use direct deposit

- File electronically with complete slips and documents

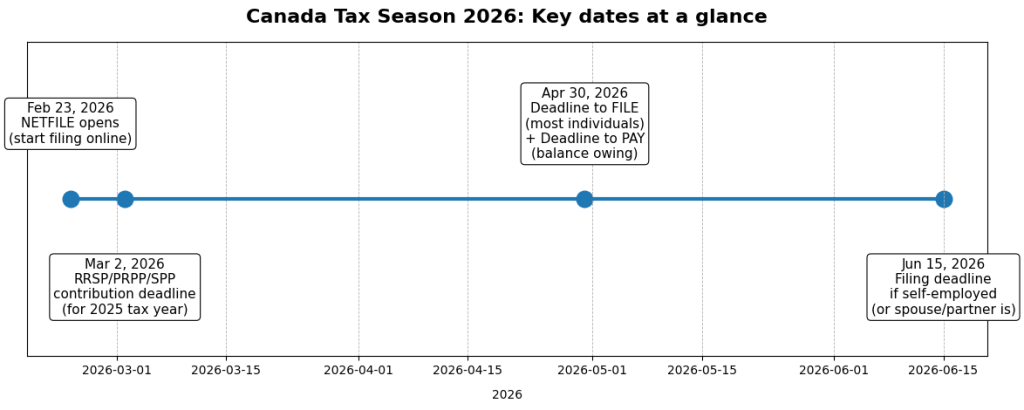

The Key Dates for Canada Tax Season 2026

For the 2025 tax return filed in 2026, these are the main deadlines.

- February 23, 2026: NETFILE opens for electronic filing.

- March 2, 2026: Deadline to contribute to an RRSP, PRPP, or SPP for the 2025 tax year.

- April 30, 2026: Filing deadline for most individuals and payment deadline for any balance owing.

- June 15, 2026: Filing deadline if you or your spouse or partner are self employed. Any balance owing is still generally due April 30.

Step One: Make Sure Your CRA Account Works

A common cause of delays during Canada tax season is trouble accessing CRA tools.

What to do now

- Sign in to your CRA account before starting your return

- Confirm your email, phone number, and security settings are current

- Test your multi factor authentication method

CRA has indicated that beginning in February 2026, users will need a backup multi factor authentication option on file.

Why this matters

Your CRA account allows you to:

- View available slips once processed

- Find your NETFILE access code

- Access your Notice of Assessment digitally

Addressing login issues early prevents delays when deadlines approach.

Step Two: Do Not File Too Early

It is tempting to file the moment NETFILE opens. Filing before receiving all slips can mean submitting an adjustment later.

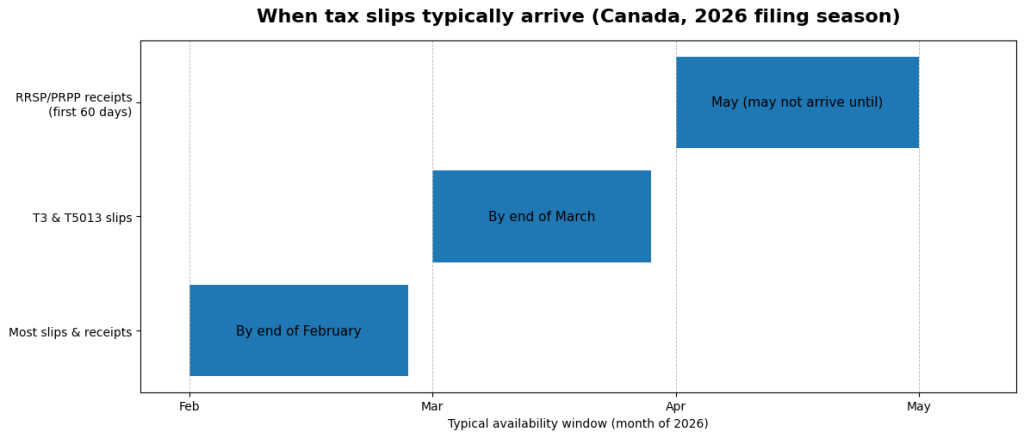

CRA guidance notes:

- Most slips and receipts are issued by the end of February

- Some slips such as T3 and T5013 may arrive by the end of March

- RRSP receipts for contributions in the first 60 days may arrive later

A practical rule

If you have trust income, partnership income, or more complex investments, waiting until late March may reduce the need for amendments.

Step Three: Gather What You Need to File

Here is a practical list of documents commonly required for Canada tax filing.

Income slips

- T4 for employment income

- T5 for investment income

- T3 or T5008 depending on investment activity

- T4E for Employment Insurance

- CPP or OAS slips

- T2202 for tuition

Deductions and credits

- RRSP contribution receipts

- Medical expense receipts

- Charitable donation receipts

- Child care receipts

- Moving expense documentation if eligible

- Work related expense documentation with required employer forms

If you are a small business owner

- Year end income statement and balance sheet

- Business income and expense summaries

- Vehicle and home office logs if claiming business use

- GST or HST and payroll records

Create a folder titled Taxes 2025 Filed 2026 and save all slips and receipts there.

Step Four: Plan for Payment Day

Filing is one step. Paying any balance owing is another.

CRA lists April 30, 2026 as the payment deadline for 2025 taxes.

If you expect to owe:

- Estimate early

- Set aside funds gradually

- Do not wait until the final week of April

Interest and penalties may apply to late payments depending on circumstances.

Step Five: Choose the Right Filing Method

You generally have three options.

File yourself using certified software

NETFILE re opens February 23, 2026 at 6:00 a.m. ET. This is often the fastest option for straightforward returns.

Use an accountant

This may be helpful if you:

- Are self employed

- Own a corporation

- Have rental or investment activity

- Want additional review and planning support

Use a free tax clinic

CRA notes that SimpleFile services may be available by invitation starting March 9, 2026 for eligible individuals with simple situations.

Common Mistakes During Canada Tax Season

- Filing before receiving all slips

- Missing the RRSP contribution deadline of March 2, 2026

- Forgetting that payment is due April 30, 2026

- CRA account access issues

- Underestimating self employed reporting complexity

Most refund delays are avoidable with preparation.

A Step by Step Plan to Prepare

- Add key dates to your calendar.

- Confirm CRA login and direct deposit details.

- Create your slips and receipts folder.

- Check in early March for missing slips.

- File once your information is complete.

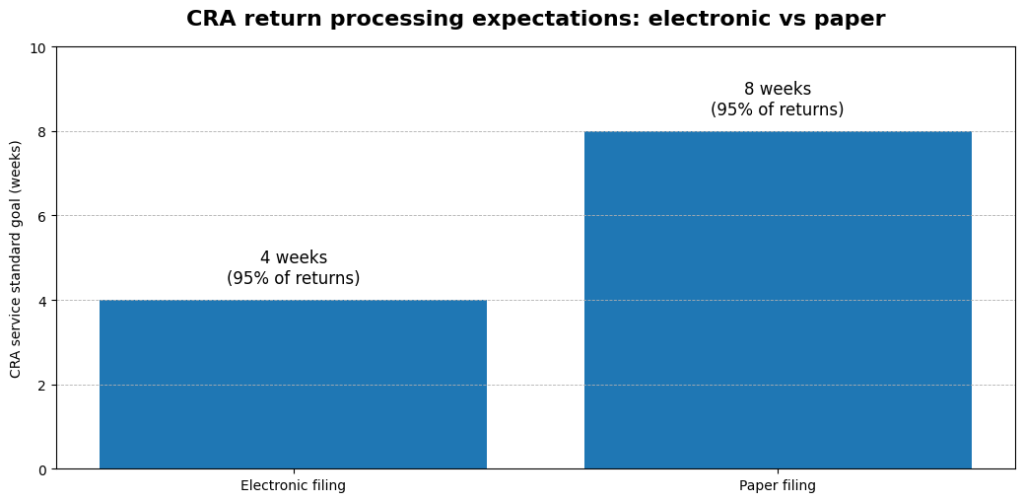

CRA notes they aim to process 95 percent of electronically filed returns within four weeks and paper returns within eight weeks, though some may take longer if selected for review.

Frequently Asked Questions

When can I start filing in 2026?

NETFILE opens February 23, 2026 for 2025 returns.

What are the main deadlines?

April 30, 2026 for most individuals. June 15, 2026 if you are self employed, though payment is still generally due April 30.

If I am self employed, do I pay later?

Not usually. Any balance owing is typically due April 30.

How long does it take to receive a refund?

CRA indicates most electronic returns are processed within four weeks, though some take longer.

What if I am missing a slip?

Most slips are issued by the end of February. If missing by the end of March, contact the issuer.

Final Reminder Before You File

Canada tax season 2026 does not have to feel rushed or stressful. The key is simple preparation, clear records, and realistic timing.

This article is general information and not personal tax advice. If you are unsure what applies to your situation, a professional review can help prevent costly mistakes.

If you would like assistance with personal filing, small business bookkeeping, payroll, or tax planning, consider speaking with a qualified tax professional.